3D Printing Stocks Explained: Smart Investment Strategies for Growth

The world of 3D printing has moved far beyond hobby projects and small plastic figurines. Today it powers aerospace parts, dental aligners, hearing aids, custom prosthetics, mold tooling, intricate jewelry, and even building construction experiments. For investors, this shift from novelty to infrastructure presents a compelling long term theme. In this guide we will unpack what 3D printing really is, how money flows through the sector, what kinds of companies operate within it, the metrics you should watch, the key risks to keep in mind, and a practical framework for researching individual names. By the end you will be able to approach 3D printing stocks with confidence and a plan.

What 3D Printing Actually Does

3D printing, often called additive manufacturing, constructs objects layer by layer from a digital design. Instead of carving material away as in traditional machining, it adds only what is required. This method enables complex internal geometries, lightweight lattice structures, fast prototyping, and in some cases direct production of end use parts. Materials range from common polymers to advanced engineering plastics, metals such as titanium and aluminum, high strength steel, resin systems for dental and medical uses, and even emerging ceramic and concrete formulas.

The value proposition depends on the application. In prototyping, engineers can shorten design cycles from weeks to days. In dental labs, customized clear aligners and crowns can be produced with high repeatability. In aerospace, weight reduction and part consolidation can improve fuel efficiency and reduce maintenance. In health care, patient specific devices improve comfort and outcomes. The uniting idea is flexibility, speed, and complexity that is hard to match with legacy methods.

The 3D Printing Value Chain

To understand the stocks, it helps to map the industry value chain. Broadly, it includes the following segments.

Hardware makers. These companies design and sell the printers. They may focus on polymers, metals, or both. Some build compact systems for offices and labs, others deliver factory scale platforms for serial production.

Materials suppliers. Powders, filaments, resins, and binders are the consumables that keep printers running. Materials carry attractive margins and generate recurring revenue. Many hardware firms also sell their own materials, locking customers into certified combinations.

Software providers. Print preparation, simulation, nesting, and workflow orchestration are critical to quality and throughput. Software can be sold as licenses or subscriptions. It often links design tools with factory systems.

Service bureaus and contract manufacturers. These firms run fleets of printers and make parts for clients that do not want to own machines. They offer design for additive services, post processing, inspection, and logistics. Service revenue can be more resilient because it spans many end markets.

Integration and training. As companies adopt additive methods, they need process validation, quality assurance, staff training, and maintenance. This layer supports adoption and often accompanies big hardware deals.

Most public 3D printing companies participate in more than one of these areas, but each tends to have a core strength. As an investor you should learn which part of the profit stack a company controls and how that informs margins and cyclicality.

Major Customer Markets

Aerospace and defense. This sector values weight savings, part consolidation, and the ability to produce spares on demand. Certification cycles are long, but once a part is qualified it can stay in production for years.

Health care and dental. Hearing aids, dental aligners, dental models, crowns, surgical guides, and some implants are already made with additive methods. The unit economics are attractive because every patient is unique, which pairs perfectly with mass customization.

Industrial and tooling. Mold inserts with conformal cooling channels, jigs and fixtures, and replacement parts all benefit from additive methods. These shorten lead times and keep production lines running.

Automotive and motorsports. Rapid prototyping is ubiquitous. For production parts, lightweight ducting, brackets, and limited run components are growing areas.

Consumer products and jewelry. Custom designs and short runs shine here. The demand can be cyclical and design centered, yet margins can be strong with direct to consumer models.

Understanding which markets a company serves will help you judge the stability of revenue and the balance between growth and regulatory hurdles.

Business Models You Will See

Hardware led model. The company sells machines and then continues to earn from materials and service contracts. Think of it as a razor and blades model in a professional setting. Hardware cycles can be lumpy, materials bring the recurring base.

Pure play materials. Some firms focus on powders and resins certified across multiple printers. This can be a high margin niche with steady growth if the portfolio is broad and well tested.

Software centric. A smaller set focuses on design tools, print prep, and production management. Subscriptions create predictability. Integrations and ease of use drive adoption.

Contract manufacturing. Here the company earns by producing parts. Capital intensity is higher but utilization and customer diversification can smooth out demand.

Hybrid portfolios. Several public names own hardware, materials, software, and services under one roof. The appeal is cross selling and control of quality. The challenge is managerial focus and integration.

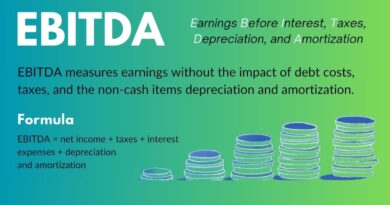

How to Evaluate a 3D Printing Stock

Revenue mix and growth drivers. Break down revenue into hardware, materials, software, and services. Materials and software often command higher gross margin and provide recurring streams. Hardware drives new customer wins but can be cyclical.

Gross margin trends. A rising mix of materials and software should expand gross margins. If margins compress, look for pricing pressure, supply chain cost, or heavy discounting to push machines.

Operating expense discipline. Many firms spend heavily on research and sales to capture share. Track operating expenses as a percent of revenue and watch for an efficient path toward operating profit as scale builds.

Cash flow and balance sheet. Additive businesses often require working capital to support inventory and long sales cycles. Review cash burn, cash on hand, and any convertible debt. A runway that supports at least the next year of operations reduces financing risk.

Installed base and utilization. The installed base of active printers is the foundation for materials revenue. Utilization drives materials pull through. Companies that share these metrics, even in broad terms, provide useful visibility.

Customer concentration and retention. A few large accounts can boost growth but also create risk. Look for evidence of diverse end markets and good renewal rates on service and software.

Regulatory approvals. In health care, materials and processes must meet strict standards. Approvals create moat like advantages but also lengthen sales cycles. Verify that the company has the required certifications for target markets.

Partnerships and ecosystem. Collaborations with aerospace primes, dental chains, hospitals, and industrial integrators can accelerate adoption. An open ecosystem that supports third party materials can broaden appeal, while a closed system can defend quality and margin.

A Look at Notable Public Players

The lineup of public companies shifts as mergers and acquisitions reshuffle the landscape. You are likely to encounter the following types of names when you research the space.

Diversified pioneers. Firms that helped define the category and still sell a wide range of printers for polymers and sometimes metals. They usually own substantial patents, maintain large installed bases, and operate global service networks.

Metal specialists. Companies focused on powder bed fusion or binder jet for metal parts, aimed at aerospace, energy, and industrial customers. Their success often hinges on certification pipelines and factory scale deployments.

Dental and medical focused companies. These firms sell resin printers, materials, and validated workflows for labs and clinics. Because each patient is unique, volumes can be large and recurring.

Contract manufacturers and service bureaus. Public firms that run fleets for many industries. They sell capacity and expertise, not hardware, and benefit from demand across sectors.

Software leaders. Companies that provide design to print tools, simulation, and production control. As adoption grows on factory floors, software that manages multiple machines and traceability becomes essential.

In addition to pure play names, consider adjacent companies that benefit from additive growth. Examples include providers of vacuum and laser components, powder atomization specialists, and industrial automation firms that supply post processing and quality inspection equipment. Some large technology corporations also sell industrial printers or support additive workflows within broader portfolios.

Growth Catalysts to Watch

Shift from prototyping to production. The largest jump in value occurs when factories adopt additive for end use parts. Case studies in aerospace, health care, and high performance automotive show the path. As costs fall and reliability improves, more parts cross the line from prototype to production.

Materials expansion. New high strength polymers, heat resistant resins, and tougher metal alloys broaden the list of printable parts. Each new material family can open fresh markets.

Automation and software. Automated powder handling, robotic depowdering, and integrated quality controls reduce labor and variability. Factory software that schedules jobs and tracks every parameter is key to scale.

Regulatory clarity. Clear rules in health care and aviation support adoption. As regulators and industry groups finalize standards, certification pathways get smoother.

Supply chain resilience. Companies seek regional production and faster response times. Additive methods reduce the need for tooling and allow localized manufacturing. That rationale remains powerful across economic cycles.

Risks and Challenges

Competition from traditional methods. Casting, molding, and machining continue to improve. For many parts, these methods remain cheaper at scale. Additive must compete on speed, design freedom, or total cost including tooling.

Hardware sales cyclicality. Capital budgets can swing with the economy. When hardware stalls, materials still sell but growth slows.

Execution risk. Integrating acquisitions, managing inventories, and supporting global customers is complex. Missed guidance and delayed projects can hurt credibility.

Valuation swings. Enthusiasm for disruptive themes can inflate valuations during boom phases. Conversely, sentiment can overshoot on the downside when growth moderates. Buying quality names at reasonable prices matters.

Technology churn. New print methods can disrupt the installed base. Investors should follow the technology roadmap and watch for platforms that retain backward compatibility or strong materials ecosystems.

Key Metrics and Ratios

When you evaluate a company in this field, track a consistent set of indicators.

Revenue growth. Look for steady year over year growth with an explanation of drivers by segment.

Gross margin. A healthy mix often means gross margin in the mid range to high range for the sector. Rising margins suggest materials and software are gaining share.

Operating margin and progress toward profitability. Even if a company invests heavily, it should show a path to operating profit as revenue scales.

Free cash flow. Cash generation tells you whether growth is self funded. Positive free cash flow is a strong sign that the model scales.

Research intensity. Spending on research as a percent of revenue shows commitment to innovation. Balance is needed so that spending supports future products without jeopardizing stability.

Net cash or net debt. A net cash position gives flexibility during slowdowns. If debt is present, check covenants and maturity schedules.

Backlog and recurring revenue percent. Backlog provides visibility into near term demand. Recurring revenue from materials, software, and service contracts stabilizes the base.

A Practical Research Framework

Use this step by step approach when examining any 3D printing stock.

First, read the latest annual report and investor presentation to understand product lines and markets. Note whether the company focuses on polymers, metals, or both. Map revenue into hardware, materials, software, and services.

Second, study case studies in target industries. Ask yourself if the company has deep references in one or two verticals or a thin presence across many. Depth in a vertical often leads to repeatable sales and stronger margins.

Third, analyze the competitive set. Identify the direct peers for each product line. Is the company winning head to head deals, or primarily selling to legacy customers who already own earlier printers

Fourth, examine the economics. Track gross margin trends, materials attach rates, and software subscription growth. Review cash flow statements to see if inventories are growing faster than sales or if receivables are stretching.

Fifth, look at product roadmaps and materials partnerships. Are new printers offering higher throughput and better reliability Is the company adding certified materials from credible suppliers Are there collaborations with aerospace primes, dental groups, or large industrial customers

Sixth, review governance and management incentives. Does leadership have a record of delivering on guidance Are incentives tied to profitable growth and cash generation

Seventh, build a simple model. Segment revenue lines, apply conservative growth rates, and test scenarios for hardware cycles. Consider a base case, a cautious case, and an optimistic case that assumes faster production adoption. Focus on free cash flow trajectory rather than perfect precision.

How 3D Printing Fits in a Portfolio

3D printing sits at the intersection of industrial technology and software. It can offer secular growth with exposure to innovation in aerospace, health care, and advanced manufacturing. That said, the stocks can be volatile. Here are ways to position the theme.

Core plus satellite. Hold a diversified industrial or technology core, then add a basket of 3D printing names as satellites. This reduces single company risk while keeping exposure to the theme.

Barbell of quality and optionality. Pair profitable, steady names with a smaller allocation to early stage innovators that could compound rapidly if production adoption accelerates.

Focus on services and materials for resilience. If you prefer smoother results, tilt toward companies with high recurring revenue from materials, software, and contract manufacturing.

Use valuation discipline. Themes can become crowded. Require reasonable multiples on sales and a visible path to cash generation.

Example Company Profiles to Guide Your Research

The following profile styles illustrate what to look for when you evaluate real companies. They are templates, not recommendations.

Polymer leader with strong dental presence. Look for a company that sells resin printers into dental labs and clinics, offers validated materials, and integrates scanners and software. Strengths include recurring resin revenue and a large installed base. Watch for regulatory updates, materials expansion, and international distribution.

Metal specialist targeting aerospace. This firm sells powder bed fusion systems with high build quality and offers a service network that supports certification. Revenue may be lumpy due to big system deals. Follow the pipeline of qualified parts, backlog with aerospace primes, and factory automation projects.

Contract manufacturer with broad vertical exposure. This company earns by producing parts for many customers. Metrics to watch include printer utilization, customer retention, and additions to certified materials and processes. The story here is about scale, process excellence, and steady cash flow.

Software and workflow provider. A company that offers design optimization, print simulation, and factory control can benefit as printers proliferate. The focus is on subscription growth, high gross margins, and sticky integrations with major design suites.

Trends That Could Shape the Next Five Years

Larger build volumes and faster throughput. Advances in laser arrays, continuous resin processes, and binder jet sintering should raise throughput and lower costs, enabling more production parts.

Digital inventories and spare parts on demand. Instead of stocking thousands of spares, companies will store qualified designs and print as needed near the point of use. This shift supports both service bureaus and in house fleets.

Sustainability gains. Additive methods can reduce waste by using only the material needed. Topology optimization designs use less material while maintaining strength, which lowers energy in use for parts like brackets and ducts.

Education and workforce development. As more schools and training centers teach additive design, the talent base widens. Better training accelerates adoption in factories.

Standards and certification maturity. Agreed standards for materials, processes, and quality will lower barriers and speed procurement decisions in regulated industries.

Putting It All Together

3D printing is no longer a curiosity. It is becoming a practical tool in the industrial and medical toolbox. For investors at 5starsstocks.com, the winning approach is to study where the technology creates measurable value, choose companies with durable advantages and recurring revenue, and maintain discipline on valuation and risk. Use the value chain map to see who controls hardware, materials, software, and services. Track gross margin trends and cash flow to judge the health of the model. Diversify across business models or emphasize the ones that fit your tolerance for volatility.

The opportunity is real, but it rewards patience and homework. Focus on companies that serve markets with clear return on investment such as dental workflows, certified aerospace parts, and industrial tooling. Follow evidence of production use, not just prototypes. Watch for materials innovation, automation, and software that ties everything together. If you apply this framework you will be positioned to identify leaders as the industry scales from thousands of printers in labs to fleets of machines on factory floors.

A Short Checklist Before You Buy

-

Do you understand which end markets drive most of the revenue

-

Is the revenue mix balanced with a healthy share from materials, software, or services

-

Are gross margins stable or rising over the past few years

-

Does the company have adequate cash to fund operations for the next year at a minimum

-

Are there credible case studies that show production use and not only prototypes

-

Is valuation reasonable relative to peers and growth prospects

-

Does management have a clear roadmap and a record of delivering on guidance

If you can answer yes to most of these questions, you are on a stronger footing.

Final Word

Investing in 3D printing is a bet on the future of manufacturing. It is a future where design freedom, speed, and local production matter more each year. Select companies with real customer traction, recurring revenue engines, and sound financial discipline. Build a diversified position sized within your risk limits. With thoughtful research and patience, 3D printing stocks can add a growth edge to a modern portfolio while aligning with the long term shift toward digital manufacturing.