EBITDA Meaning and Applications in Business Valuation

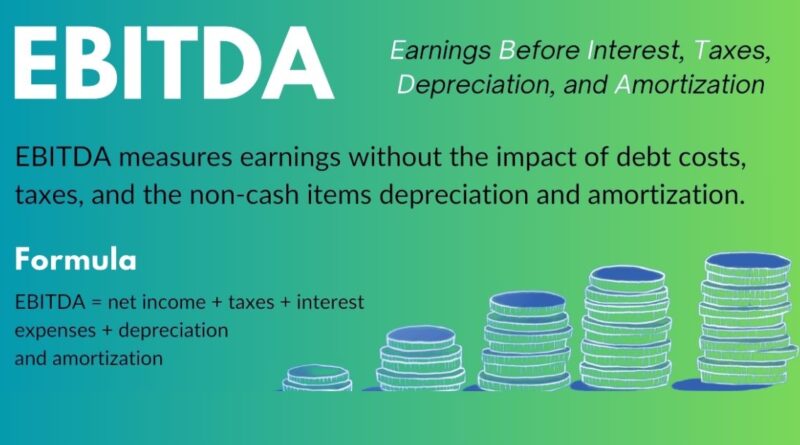

EBITDA is a widely used financial metric that measures a company’s operating performance without considering the effects of financing decisions, accounting methods, and tax environments. The term stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It provides investors, analysts, and company management with a clearer view of the operational profitability of a business by excluding certain non-operating expenses and non-cash charges. This metric is often used in financial analysis, valuation, and comparison of companies across industries, particularly when companies have varying levels of debt, tax rates, or capital investments. By focusing on the core profitability of operations, EBITDA helps to standardize performance evaluation.

What Does EBITDA Stand For

The letters in EBITDA represent the following:

-

Earnings: The net profit generated from operations before making adjustments.

-

Before Interest: Excludes the cost of interest on debt to focus purely on operational outcomes.

-

Taxes: Excludes income taxes as they can vary by jurisdiction and do not directly reflect operational efficiency.

-

Depreciation: Excludes depreciation expenses that are non-cash charges based on past capital investments.

-

Amortization: Excludes amortization expenses, which are similar to depreciation but relate to intangible assets.

EBITDA Formula

The most common formula for calculating EBITDA is:

EBITDA = Net Income + Interest Expense + Taxes + Depreciation + Amortization

Alternatively, if you have the operating profit or EBIT (Earnings Before Interest and Taxes), you can calculate it as:

EBITDA = EBIT + Depreciation + Amortization

Example of EBITDA Calculation

Let us consider a fictional company, Alpha Traders, with the following figures for the year:

-

Net Income: $2,000,000

-

Interest Expense: $200,000

-

Taxes: $500,000

-

Depreciation: $300,000

-

Amortization: $100,000

Using the formula:

EBITDA = 2,000,000 + 200,000 + 500,000 + 300,000 + 100,000

EBITDA = $3,100,000

This figure shows Alpha Traders’ earnings from operations without considering financial structure, tax environment, or non-cash expenses.

Why is EBITDA Important

EBITDA has become a crucial tool for financial analysts, investors, and business owners because it isolates operational performance. The importance of EBITDA can be summarized as follows:

-

Focus on Core Operations

By excluding interest, taxes, and non-cash charges, EBITDA reflects how much profit the core business activities are generating. -

Easier Comparison Between Companies

It allows analysts to compare companies operating in different tax jurisdictions or with different capital structures on a more equal footing. -

Valuation Tool

Investors often use EBITDA in valuation multiples such as EV/EBITDA (Enterprise Value to EBITDA) to determine if a company is undervalued or overvalued. -

Performance Tracking

It helps track operational performance over time without distortions caused by changes in tax policies, debt levels, or accounting methods.

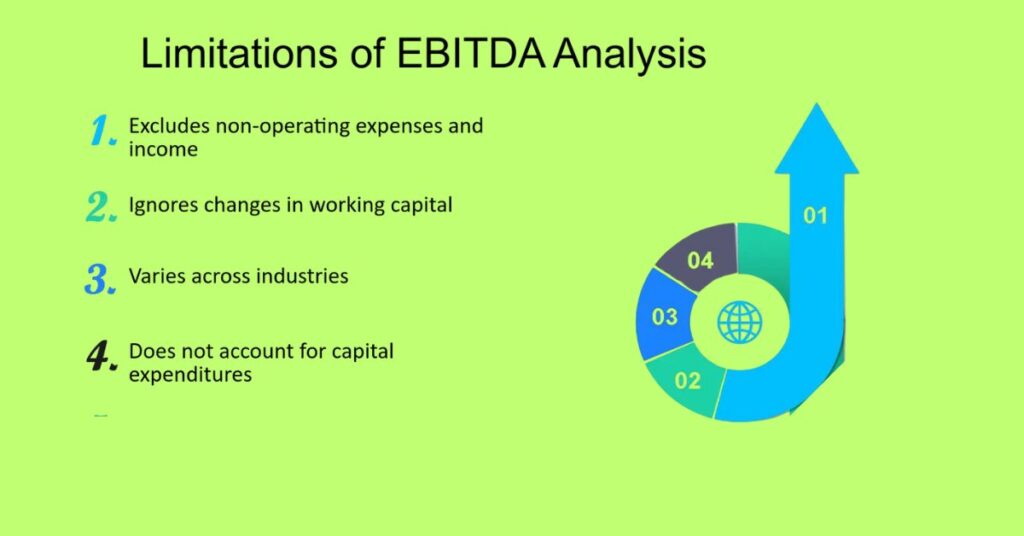

Limitations of EBITDA

While EBITDA is useful, it is not a perfect measure and has several limitations:

-

Excludes Capital Expenditures: EBITDA does not account for money spent on upgrading or maintaining assets.

-

Ignores Working Capital Changes: It does not reflect cash tied up in inventory or receivables.

-

May Be Manipulated: Management can adjust EBITDA to paint a more favorable picture of performance.

-

Not a GAAP Metric: Since it is not a Generally Accepted Accounting Principles measure, companies have flexibility in its calculation, which can lead to inconsistencies.

EBITDA vs Other Financial Metrics

EBITDA is often compared to other profitability measures to understand its position in financial analysis.

| Metric | Includes/Excludes | Best Use Case |

|---|---|---|

| Net Income | Includes all expenses, taxes, and interest | Bottom-line profitability |

| EBIT | Excludes interest and taxes | Focuses on operating profit before financing and tax effects |

| Operating Cash Flow | Adjusts net income for non-cash items and working capital changes | Cash generated from operations |

| Gross Profit | Only deducts cost of goods sold from revenue | Measures production efficiency |

EBITDA vs Net Income

-

EBITDA focuses on operational earnings without financing or accounting adjustments.

-

Net Income includes all expenses, taxes, and interest, showing the final profit available to shareholders.

For example, a company with high debt may have strong EBITDA but low net income due to high interest expenses.

EBITDA vs Operating Cash Flow

-

EBITDA is an accounting measure that ignores working capital changes.

-

Operating Cash Flow reflects the actual cash generated from operations and is therefore more closely linked to liquidity.

Investors often use both metrics together to get a complete view.

EBITDA and Company Valuation

In valuation, EBITDA is frequently used in multiples such as EV/EBITDA. This ratio compares the enterprise value of a company to its EBITDA and helps assess if the company is trading at a fair value compared to peers.

For instance, if two companies in the same industry have similar growth prospects but different debt levels, EV/EBITDA can provide a clearer comparison than P/E ratios.

Industry Examples of EBITDA Use

-

Telecommunications

Telecom companies often have high capital expenditures and depreciation. EBITDA allows analysts to focus on operational earnings without being affected by heavy non-cash charges. -

Hospitality

Hotels and resorts benefit from EBITDA analysis since it strips out property depreciation and financing structures, revealing true operational profitability. -

Manufacturing

Manufacturing businesses with large investments in machinery can use EBITDA to highlight profitability without depreciation effects.

Adjusted EBITDA

Many companies report Adjusted EBITDA, which modifies the standard EBITDA formula to exclude non-recurring expenses, restructuring costs, or other unusual items. This aims to show a normalized operational performance. However, analysts must review such adjustments carefully to ensure they are reasonable and not simply an attempt to inflate results.

Criticism of EBITDA

Critics argue that EBITDA can be misleading because it excludes critical expenses such as depreciation, which represents the wear and tear of physical assets, and interest, which reflects the cost of debt financing. Over-reliance on EBITDA can create an overly optimistic view of profitability, particularly for capital-intensive businesses.

How Investors Use EBITDA

Investors and analysts typically use EBITDA to:

-

Compare profitability across similar companies regardless of their capital structure

-

Identify operational strengths and weaknesses

-

Evaluate a company’s ability to service debt through operational earnings

-

Determine acquisition attractiveness using valuation multiples

EBITDA in Credit Analysis

Credit rating agencies and lenders use EBITDA to assess a company’s debt repayment capacity. By comparing EBITDA to interest expenses or total debt, they can determine the company’s leverage and repayment ability. Common ratios include:

-

EBITDA Coverage Ratio = EBITDA / Interest Expense

-

Debt to EBITDA Ratio = Total Debt / EBITDA

EBITDA in Mergers and Acquisitions

In mergers and acquisitions, EBITDA serves as a quick reference for operational profitability. Buyers often assess the EV/EBITDA multiple to determine the fair purchase price for a business. A higher multiple might indicate strong growth potential, while a lower multiple could suggest risks or underperformance.

EBITDA Trends and Analysis

Historical EBITDA trends can indicate whether a company is improving its operational efficiency. Investors look for consistent growth in EBITDA as a sign of competitive strength. However, sudden spikes or drops in EBITDA should be investigated to determine if they result from genuine operational changes or accounting adjustments.

Conclusion

EBITDA remains a popular metric for analyzing company performance, valuing businesses, and comparing profitability across industries. Its focus on core operations and exclusion of financing, taxes, and non-cash charges makes it especially useful in standardizing performance evaluation.

However, it should never be used in isolation. Combining EBITDA analysis with other metrics such as net income, operating cash flow, and free cash flow provides a more accurate and comprehensive financial picture. By understanding both the strengths and limitations of EBITDA, investors, business owners, and financial analysts can make more informed decisions.

FAQ

What does EBITDA stand for

EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization. It measures a company’s operating performance without certain expenses.

Why is EBITDA important

It focuses on core business profitability and helps compare companies with different debt levels tax rates and accounting methods.

How is EBITDA calculated

EBITDA is calculated by adding interest taxes depreciation and amortization to net income. It can also be derived from EBIT by adding depreciation and amortization.

Is EBITDA the same as profit

No. EBITDA shows operational earnings before certain expenses while profit usually refers to net income after all expenses.

Can EBITDA be negative

Yes. A negative EBITDA means the company’s operating expenses exceed its revenue before considering interest taxes depreciation and amortization.